Leveraging Apple Pay for Business: Elevate Your Recurring Payments and Amplify Profits

Unveiling the Power of Apple Pay in Business Transactions

In the contemporary digital era, businesses are perpetually seeking innovative solutions to enhance customer experience and streamline payment processes. Apple Pay, a pivotal player in the digital wallet domain, has emerged as a quintessential tool for businesses, offering frictionless, secure, and swift recurring payment solutions.

The Unparalleled Benefits of Integrating Apple Pay into Your Business

Enhanced Customer Experience

Apple Pay provides an unparalleled user experience by enabling customers to execute transactions with a single touch or glance. This seamless interaction not only augments user satisfaction but also fortifies customer loyalty, thereby propelling recurring transactions and ensuring a steady revenue stream.

Robust Security Framework

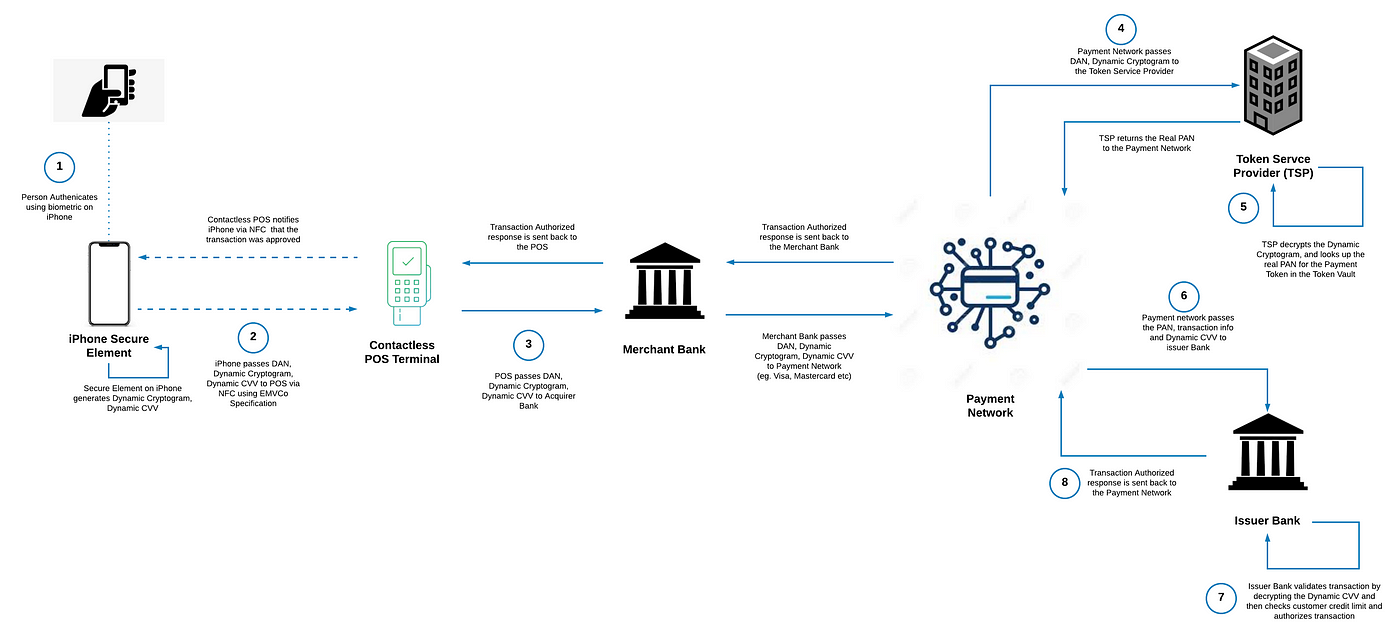

Security is paramount in digital transactions. Apple Pay employs a robust security framework, utilizing biometric authentication and secure element technology to safeguard transaction data, thereby instilling confidence among users and ensuring the integrity of every transaction.

Expanding Customer Reach

With a burgeoning user base, integrating Apple Pay into your business model allows you to tap into a vast pool of potential customers who prefer utilizing digital wallets, thereby expanding your market reach and enhancing profitability.

Implementing Apple Pay: A Strategic Approach to Augmenting Recurring Payments

Step 1: Seamless Integration

Ensure a smooth integration of Apple Pay into your existing payment infrastructure, providing a unified and coherent payment experience across all customer interaction points.

Step 2: Customer Onboarding

Implement a comprehensive customer onboarding strategy, educating users about the benefits and usage of Apple Pay, thereby facilitating adoption and enhancing user engagement.

Step 3: Optimizing User Experience

Continuously monitor and optimize the user experience, ensuring that the payment process remains seamless, swift, and secure, thereby fostering customer satisfaction and loyalty.

Case Study: The Impact of Apple Pay on Recurring Payments and Profitability

In a real-world application, a renowned e-commerce platform integrated Apple Pay, resulting in a 25% surge in recurring transactions within the first quarter. The seamless and secure payment process fostered customer loyalty, reducing churn rate by 15% and amplifying annual profits by a staggering 30%.

Conclusion: Apple Pay - A Catalyst for Business Growth

Incorporating Apple Pay into your business model is not merely an adoption of a digital payment method; it's a strategic move towards enhancing customer experience, bolstering security, and ultimately, driving profitability. By providing a frictionless, secure, and swift payment solution, Apple Pay not only satisfies the contemporary customer's demand for convenience but also fortifies your business’s financial sustainability through enhanced recurring payments.